Best Application for track your income and expense

Simply manage your finances

Login RegisterSimply manage your finances

Login RegisterThis website developed for record and analyze your personal income and expense. XpenseTracker helps you track your spending and set budgets effortlessly for better financial management

Stay updated with the financial news and updates to help you make smarter money management decisions.

Read News

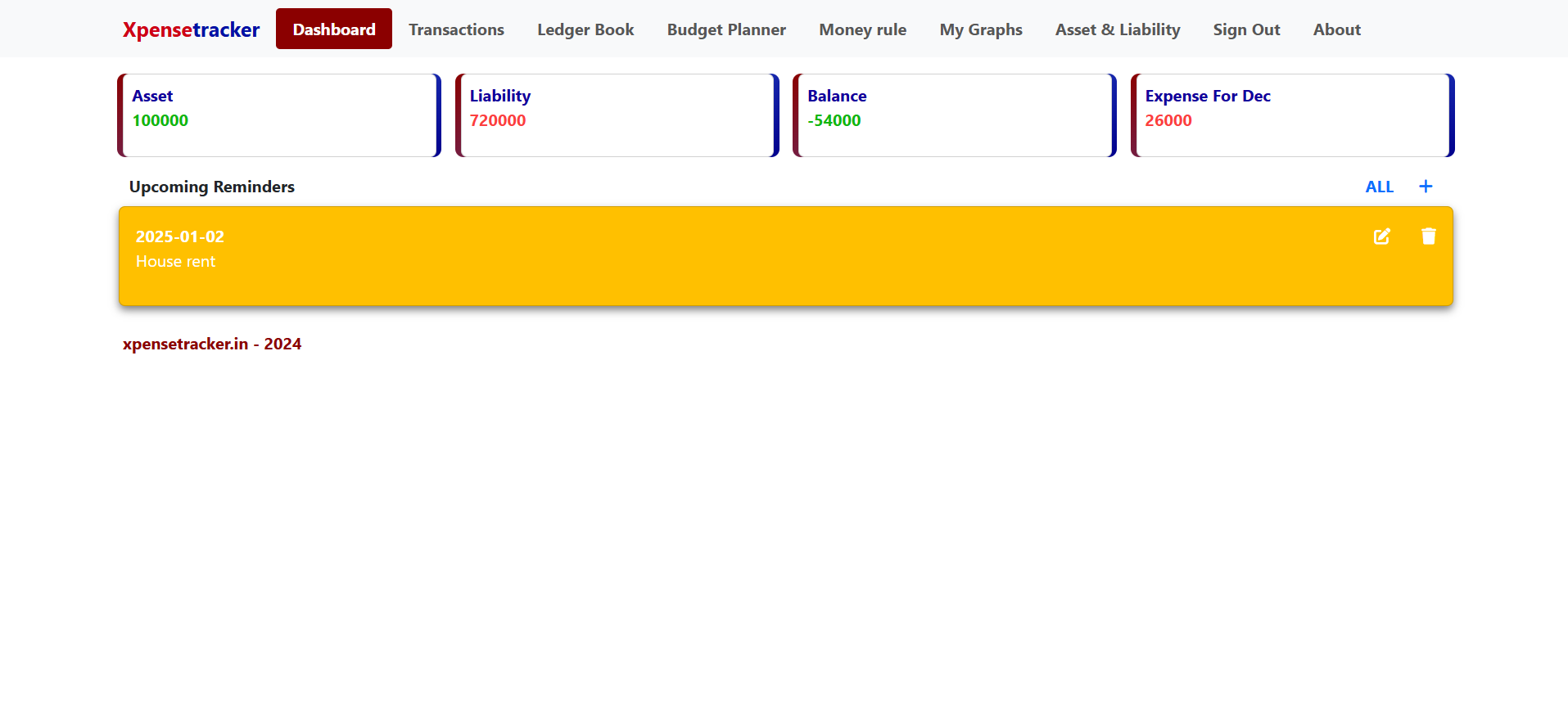

Set reminders for your upcoming payments, savings goals, or due bills. Simply choose your desired dates, add personalized notes, and stay on top of your financial commitments. This feature helps you stay organized, avoid late fees, and achieve your financial goals effortlessly.

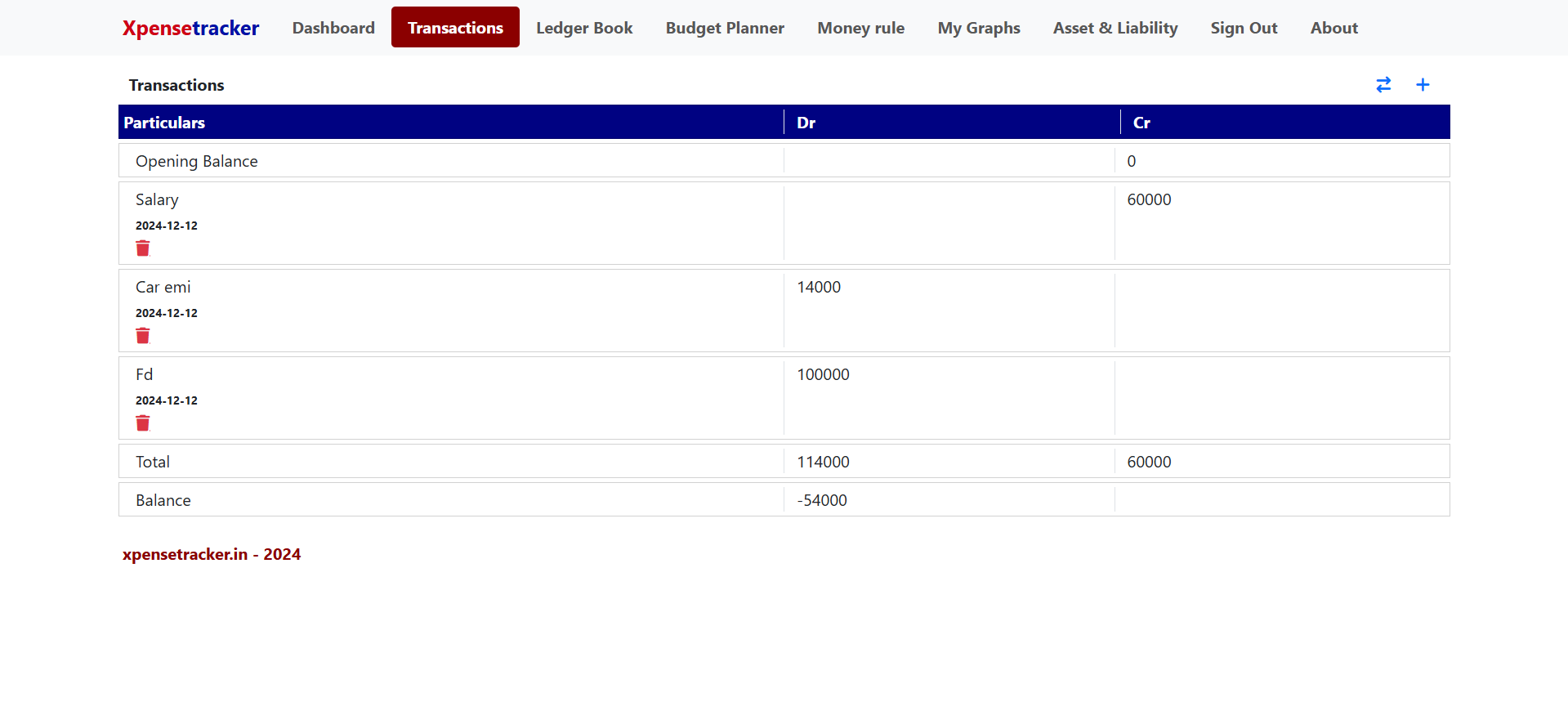

The Transactions feature in a money management app offers a clear and organized way to manage your income and expenses. It enables users to effortlessly record and track every financial transaction, ensuring complete transparency. By monitoring transactions, users can identify spending patterns, stay within budget, and work toward achieving their financial goals. This powerful tool puts users in full control of their finances, simplifying money management like never before.

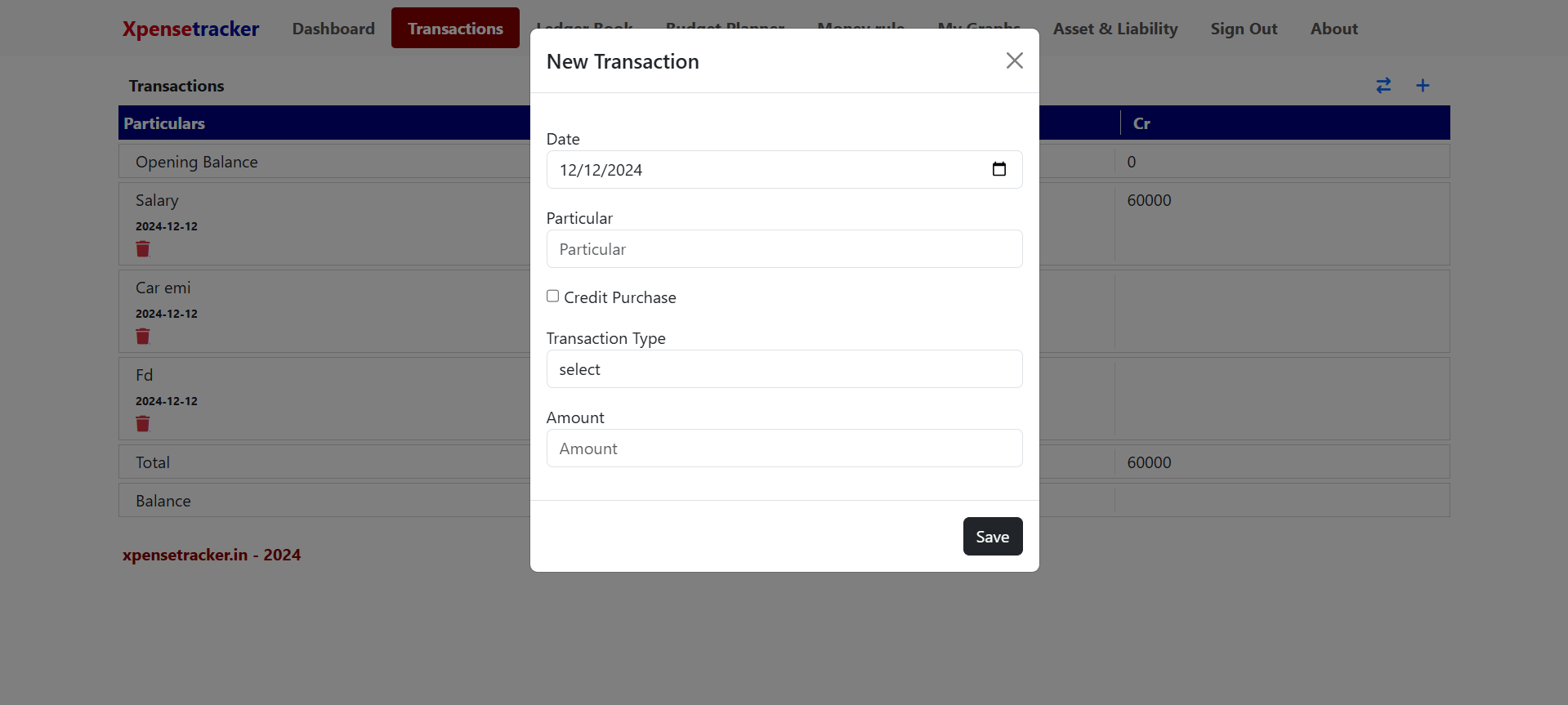

Add transactions effortlessly with details such as date, particulars, credit purchase, EMI, loan duration, and more. Our app supports a wide variety of transaction types, including income, expenses, loan taken, loan repayment, investment or asset purchase, and withdrawal or asset sale. By categorizing each transaction, users can track their finances accurately and gain valuable insights into their spending patterns, loan management, and investments, helping them stay organized and stay on track with their financial goals.

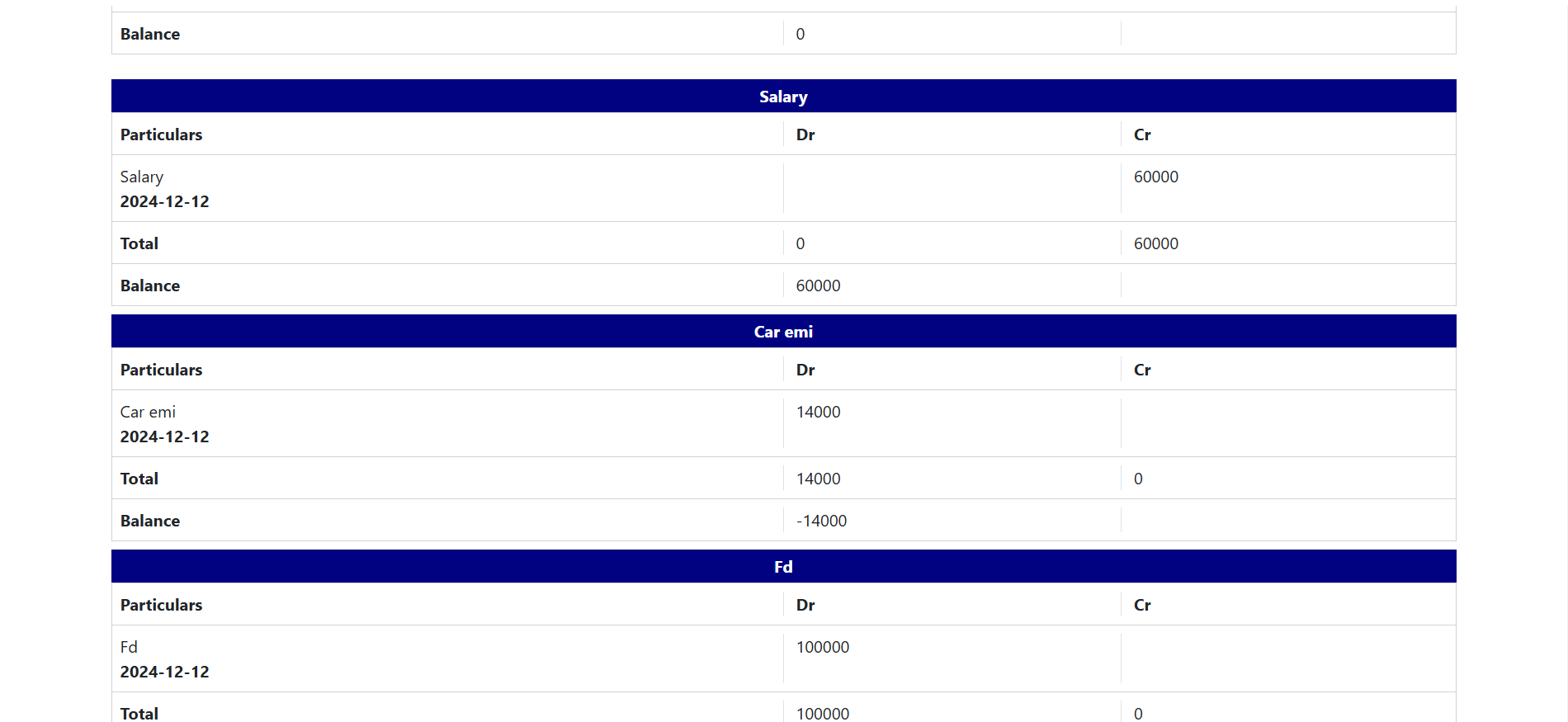

The Ledgers feature in a money management app offers a detailed record of all financial transactions, organized by individual accounts. It serves as an essential tool for tracking the flow of money in and out of each account, providing a clear overview of your financial activities. Users can easily view balances, identify trends, and reconcile accounts, making it easier to manage finances effectively. By consolidating all financial data in one place, the ledger helps users stay organized, maintain accurate records, and ensure financial transparency—crucial elements for achieving their financial goals.

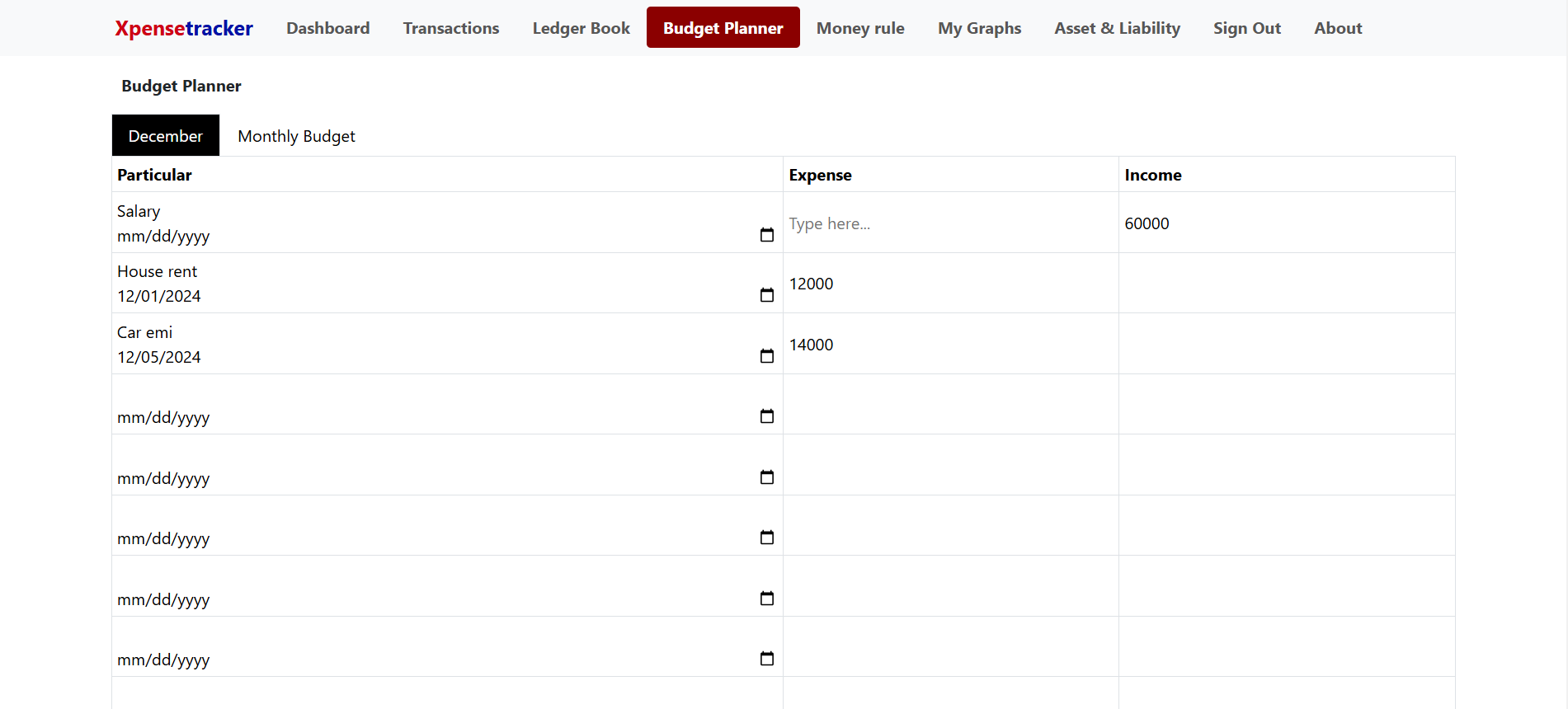

The Budget Planner feature in a money management app allows users to set budgets for both the current month and the upcoming month. The "current month budget" helps users allocate funds for immediate expenses, while the "next month budget" allows them to plan ahead for future costs, including bills, savings goals, and investments. This dual budgeting system ensures users can stay on top of their finances, avoid overspending, and manage both short-term and long-term financial goals effectively

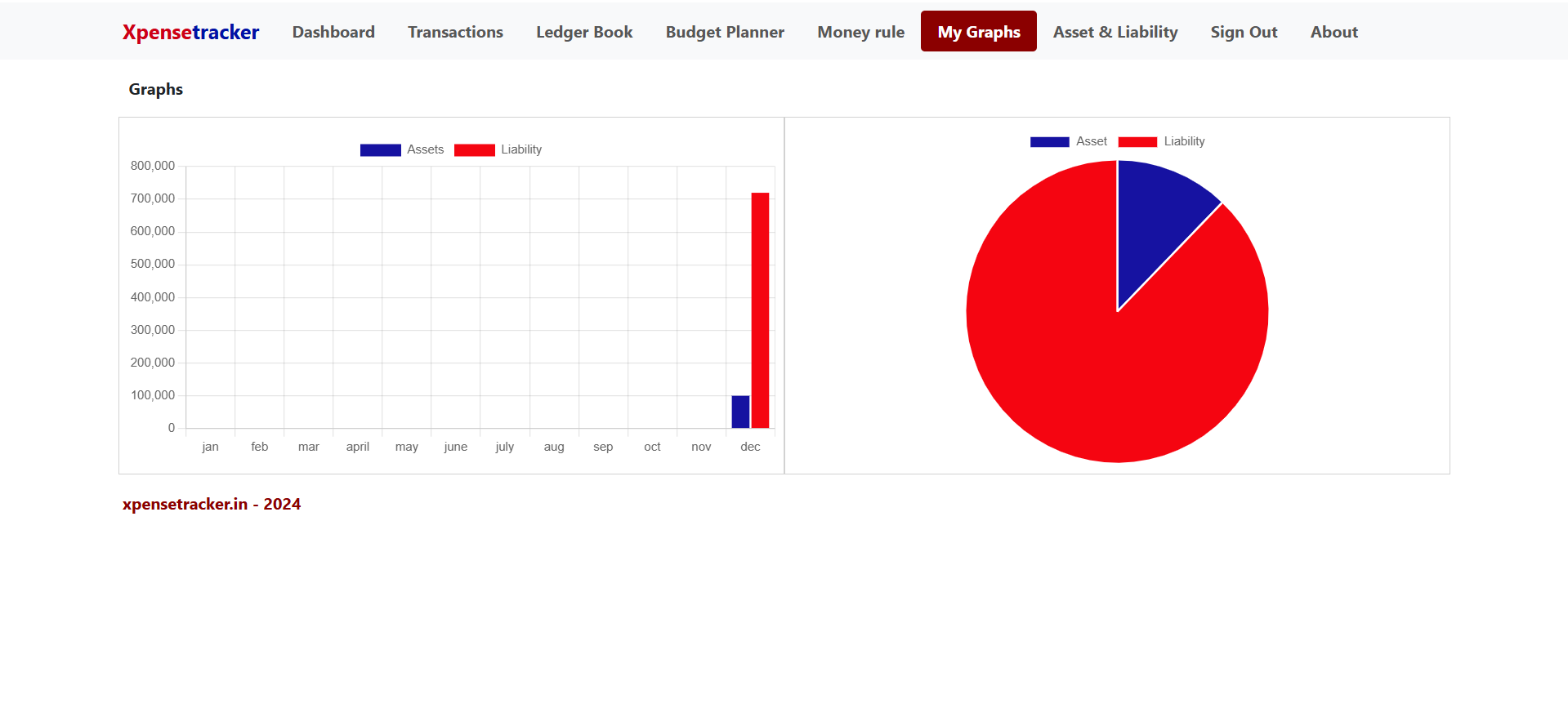

The Asset & Liability With Graphs feature in a money management app helps users track and visualize their financial health by categorizing their assets and liabilities, allowing you to track and compare your assets and liabilities both on a monthly basis and for the current year.Users can record their assets, such as property, savings, and investments, and liabilities, like loans or debts, and then view this information through easy-to-read graphs. The monthly view helps track progress and trends over time, while the current year overview gives users a larger perspective of their overall financial situation. With these visual tools, users can better understand their net worth, make informed financial decisions, and work towards improving their financial stability throughout the year.

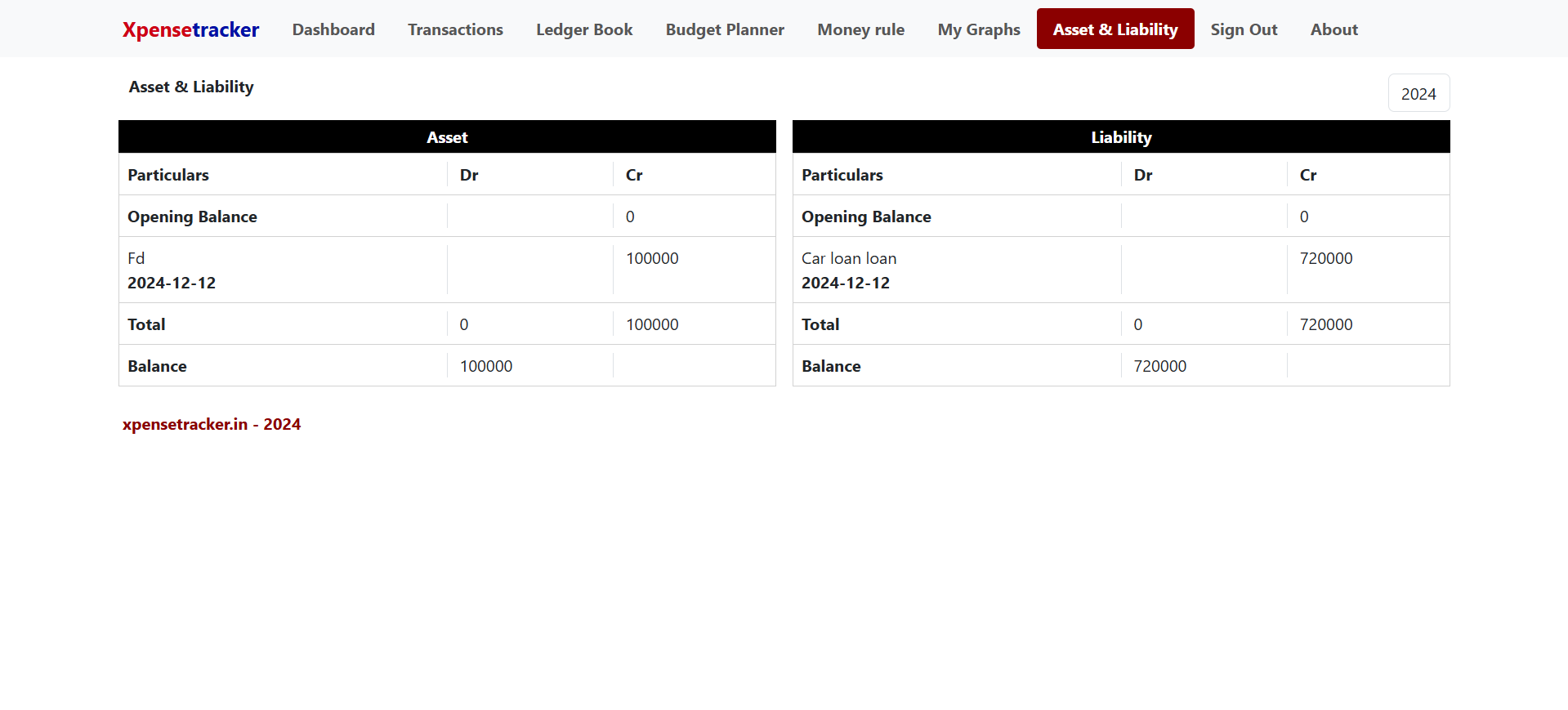

The "Asset & Liability" account feature in a money management app allows users to view their financial data for both the current year and past periods. This feature provides a comprehensive view of assets (e.g., property, savings, investments) and liabilities (e.g., loans, debts), with the ability to compare data across different timeframes. Users can track their financial progress, analyze changes in their net worth over time, and make informed decisions about managing debts, building assets, and improving their overall financial health. By reviewing both the current year and past periods, users can identify trends and better plan for future financial goals.